Don’t Fix What Isn’t Broken

By Glen Wunderlich

Charter Member Professional Outdoor Media Association (POMA)

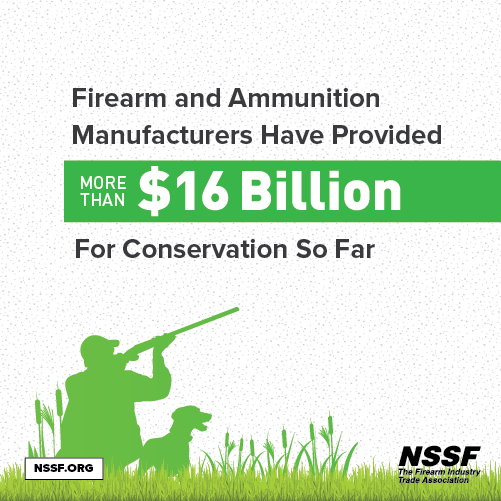

When I heard that some politicians have proposed a bill to eliminate portions of the Pittman-Robertson Act, my first question was why. My next question was how America would fund its successful wildlife conservation initiatives, as it has for almost 100 years. After researching what was behind this political posturing, I found only evidence to validate the lower-than-dirt rating of Congress.

Andrew Clyde (R-GA) introduced the RETURN our Constitutional Rights Act, which is an acronym for Repealing Excise Tax on Unalienable Rights Now. The half-baked plan would eliminate the 11 percent federal excise tax on firearms and ammunition. Sounds great! Mr. Clyde’s rationale is that excise taxes on firearms and ammunition threaten Second Amendment rights. However, with firearms sales continuing at an astounding pace, the evidence doesn’t seem to support his theory. Nevertheless, the bill was introduced with support from more than 50 Republican representatives.

A look at Mr. Clyde’s website explains that his plan was hatched in retaliation to another asinine proposal by Don Beyer (D-VA) “to impose a 1,000 percent excise tax on any type of semi-automatic firearm.”

“The sole purpose of this dictatorial proposal is to weaponize taxation in order to price the Second Amendment out of the reach of average Americans — leaving citizens vulnerable and unable to exercise their inalienable right to keep and bear arms.”

While Representative Clyde may have a point, his solution lacks a thorough understanding of how sportsmen and women uncommonly support the current system.

“The irony of this whole thing—to say it’s unconstitutional to tax something that is a stated right in the Constitution—is that hunters asked for [the Pittman-Robertson Act] in the 1930s, and have loved it ever since,” says Whit Fosburgh, president and CEO of the Theodore Roosevelt Conservation Partnership. Fosburgh notes that excise taxes have helped the shooting sports and hunting industries grow: They’ve paid for shooting ranges, hunter education programs, wildlife management, and habitat restoration. “You name it, stuff that we [hunters and gun owners] care about has been funded by this. The notion that it’s somehow an infringement on rights is absolutely ludicrous.”

So, how would America fund its enviable conservation model under Mr. Clyde’s plan? Simple. Tax “Big Oil.”

“The offset he’s looking to justify his bill [with] is a little bit laughable, and naïve given that so many other existing funding mechanisms rely on offshore oil and gas revenues,” says John Gale, conservation director for Backcountry Hunters and Anglers, another organization that signed the letter in May. “Those are market-based revenues that depend on consistency … offshore oil and gas revenues are the opposite of dependable. You see dips and spikes there. And as our energy portfolio becomes more diverse and includes more renewable energy development, those Outer Continental Shelf dollars are likely to decline down the road, not necessarily increase, to meet even the current demands—let alone the future demands—states will have for their wildlife budgets.”

With 43 hunting, conservation, and gun rights groups opposing changes to excise taxes on guns and ammunition including the Boone and Crockett Club, National Deer Alliance, Pope & Young Club, and the Sportsmen’s Alliance and the millions of members each represent, I am with them. If it ain’t broke, don’t fix it.