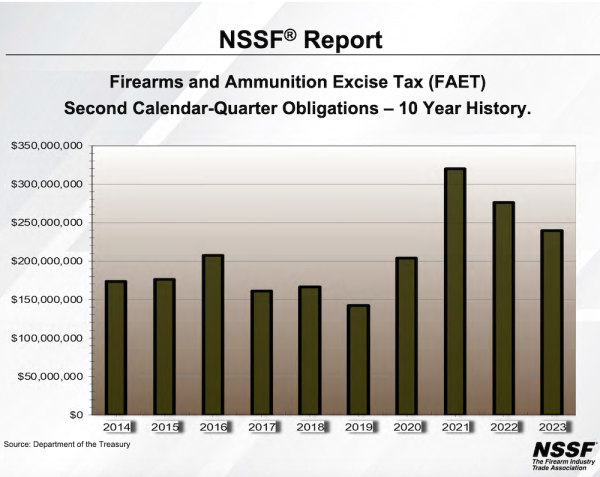

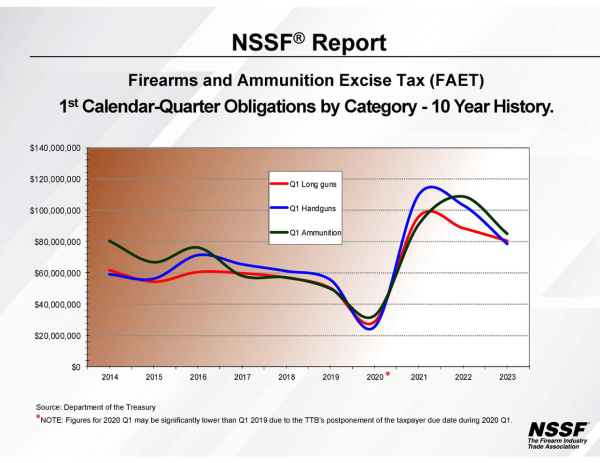

First Quarter Excise Tax Obligations for 2023 Down 23.9 Percent Over Last Year

The latest Firearms and Ammunition Excise Tax Collection report released by the Department of the Treasury indicates that firearm and ammunition manufacturers reported tax liabilities of $243.8 million in the 1st calendar quarter of 2023; down 18.9 percent over the same time period reported in 2022. The report, which covers the time period of January 1, 2023, through March 31, 2023, shows that $78.7 million was due in taxes for Pistols and Revolvers, $80.3 million for Firearms (other)/ Long Guns and $84.9 million for Ammunition (shells and cartridges). Compared to the January to March quarter 2022, tax obligations were down 23.9 percent for Pistols and Revolvers, down 9.2 percent for Firearms (other)/ Long Guns and down 21.9 percent for Ammunition (shells and cartridges). ??????

Translation to sales:

Using the latest tax liabilities reported as an indication of sales, a projection of $2.3 billion was generated for the 1st Quarter calendar year of 2023.

Pistols and Revolvers: $78,659,035.67 / .10 = $786,590,356.70 = $786.6 million for Pistols and Revolvers

Firearms (other) /Long guns: $80,286,632.64 / .11 = $729,878,478.55 = $729.9 million for Firearms (other) / Long guns

Ammunition (shells & cartridges): $84,899,638.59 / .11 = $771,814,896.27 = $771.8 million for Ammunition (shells & cartridges)

Total estimation of sales for the quarter: $2,288,283,731.52

Note: These figures reflect what excise taxes the manufacturers have filed and do NOT reflect retail mark-up and final retail sales. These figures represent tax liabilities reported on returns filed as of July 31, 2023 and are only accurate as of this date. Late filed or amended tax returns could be filed for this tax period after the date of this email. These late filed or amended returns will increase or decrease the tax liability for this period. Future Alcohol and Tobacco, Tax and Trade Bureau (TTB) statistical releases will include the updated liabilities and therefore will not agree with the figures provided in this email. In addition, these amounts are the gross amounts of liability for each category — not the net amount of FAET paid for each category. These amounts do not reflect increasing or decreasing adjustments.