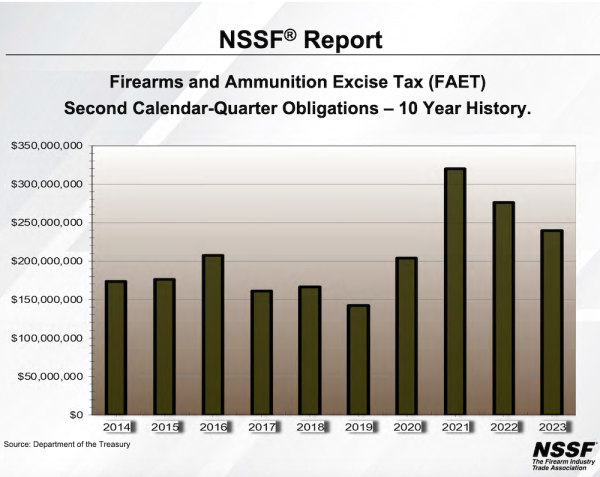

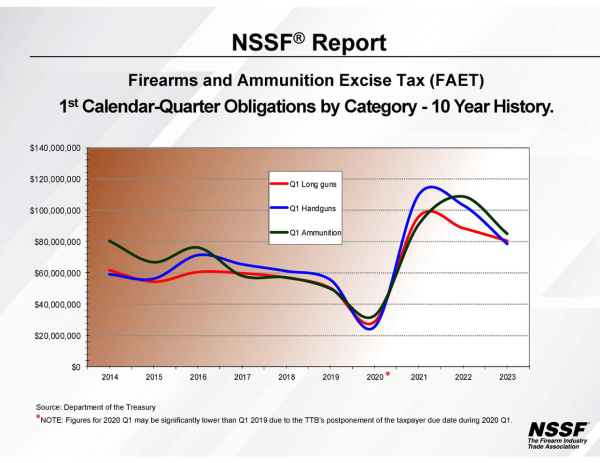

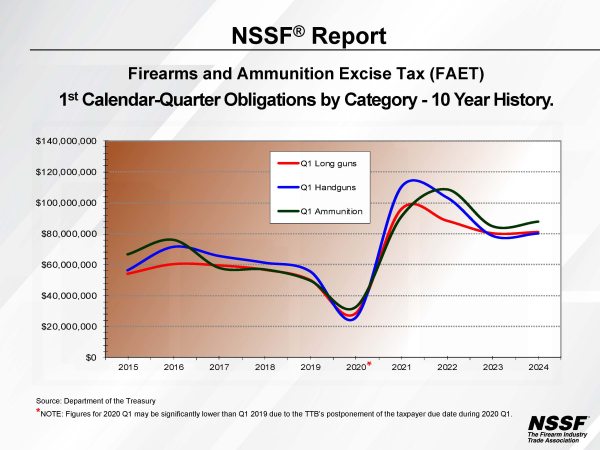

First Quarter Excise Tax Obligations for 2024 Up 2.1 Percent Over Last Year

The latest Firearms and Ammunition Excise Tax Collection report released by the Department of the Treasury indicates that firearm and ammunition manufacturers reported tax liabilities of $249.06 million in the 1st calendar quarter of 2024; up 2.1 percent over the same time period reported in 2023.

The report, which covers the time period of January 1, 2024, through March 31, 2024, shows that $80.1 million was due in taxes for Pistols and Revolvers, $81.1 million for Firearms (other)/ Long Guns and $87.9 million for Ammunition (shells and cartridges). Compared to the January to March quarter 2023, tax obligations were up 1.9 percent for Pistols and Revolvers, up 1.0 percent for Firearms (other)/ Long Guns and up 3.5 percent for Ammunition (shells and cartridges).

Translation to sales:

Using the latest tax liabilities reported as an indication of sales, a projection of $2.3 billion was generated for the 1st Quarter calendar year of 2024.

Pistols and revolvers: $80,115,837.38 / .10 = $801,158,373.80 = $801.2 million for Pistols and Revolvers

Firearms (other) /Long guns: $81,095,862.08 / .11 = $737,235,109.82 = $737.2 million for Firearms (other) / Long guns

Ammunition (shells & cartridges): $87,853,420.98 / .11 = $798,667,463.45 = $798.7 million for Ammunition (shells & cartridges)

Total estimation of sales for the quarter: $2,337,060,947.07